| Carbon Equity raised another €100 million for climate solutions through its Climate Tech Portfolio Fund II. This exceeded its initial target of €75 million and more than doubled the size of Fund I, which closed at €42 million in 2022. The Climate Tech Portfolio Fund II invests in 7 to 10 selected private equity and venture capital funds and indirectly in 150 to 200 critical climate solutions including solutions such as green hydrogen, battery technology, carbon-free cement, (industrial) heat pumps, bioplastics, smart thermostats, and next generation proteins. Read more: |

|

Enfuro Ventures is proud to be part of this finance round that welcomes BlackFin as new investor in Carbon Equity.

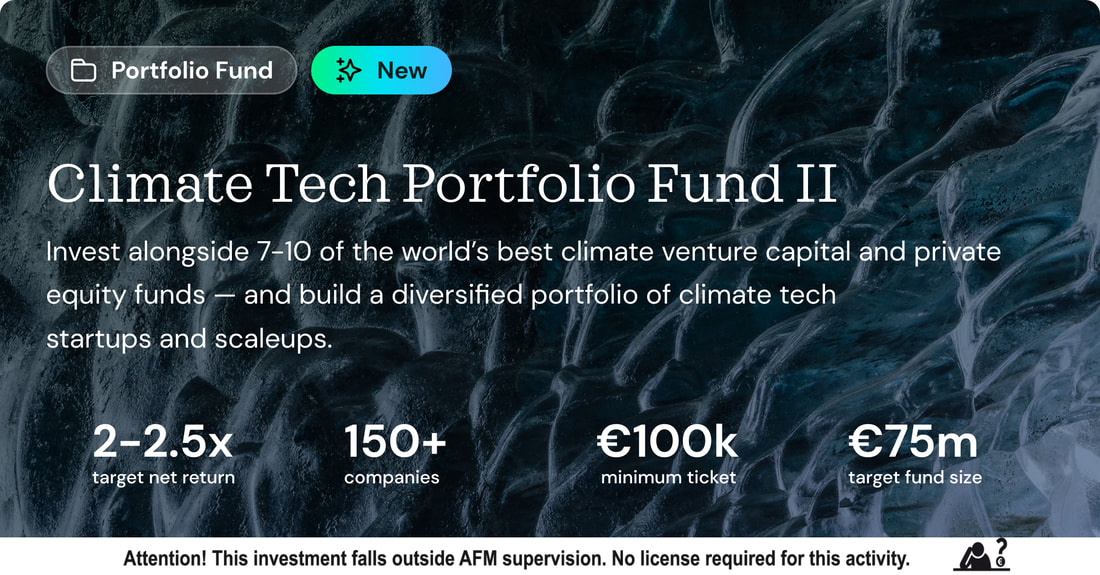

Read more... Carbon Equity, the world’s first climate venture capital and private equity fund investment platform, announced a strong first close of its Climate Tech Portfolio Fund II, which launched in February. Its Fund II allows investors to build a diversified portfolio of climate tech startups and scaleups by investing with the best climate funds.

Read more... In Q4 2022 Carbon Equity successfully closed Decarbonization Fund I at €40+mln, 160% of its €25mln target. Now Carbon Equity launched Climate Tech Portfolio Fund II to invest another €75mln in over 150 climate tech companies.

Learn more... Carbon Equity has been selected as one of the Dutch leading FinTech startups to join Techleap.nl’s Rise programme.

Read more about Techleap.nl’s Rise programme...

Carbon Equity, the world’s first private market climate investing platform, announced its oversubscribed seed round of €1.8 million. Enfuro Ventures is among the existing shareholders that increased their investment in Carbon Equity.

Read more... This is a European-focused, growth equity investment fund that will channel its funding to later-stage climate solutions — to enable them to be adopted at scale.

Read more... Azolla Ventures is now a part of Carbon Equity's Decarbonization Fund I.

Azolla Ventures, a spin-off from Prime Coalition, brings a fundamentally new approach to venture investing. It integrates catalytic capital with traditional venture capital to invest in early-stage climate tech opportunities that have the potential for gigaton-scale carbon reduction but are overlooked by the market. Read more... Clean Energy Ventures is now a part of Carbon Equity's Decarbonization Fund I. Clean Energy Ventures only invest in climate companies capable of mitigating 2.5 gigatons of CO2 by 2050.

Read more... |

Categories

All

Archives

August 2023

|

RSS Feed

RSS Feed